U.S. Trade Show Industry's Q4 2023 Performance Surges Ahead, Approaching Pre-Pandemic Levels

The Center for Exhibition Industry Research (CEIR) reported a significant recovery in the U.S. business-to-business (B2B) exhibition industry for the fourth quarter (Q4) 2023, citing a 15% year-over-year increase in overall exhibition performance that measures exhibitors, net square footage, attendees and real revenues.

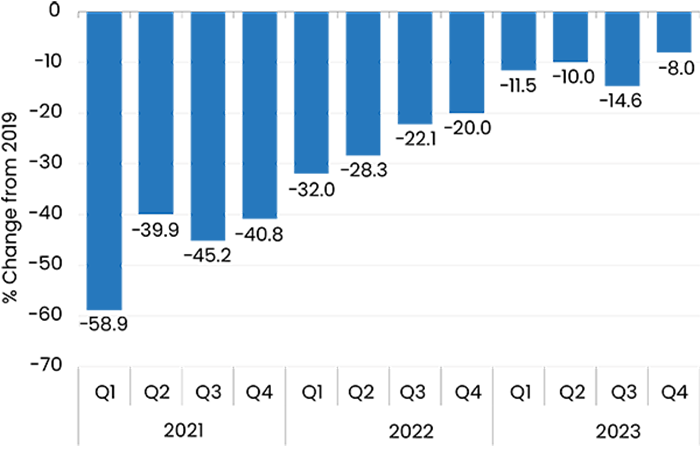

The industry’s performance is nearing pre-pandemic levels, with the Q4 2023 results showing only an 8% lag compared to the same period in 2019, according to the latest CEIR Total Index. This represents a significant improvement from the 41% and 20% shortfalls observed in Q4 2021 and Q4 2022, respectively. Indicating strong recent momentum, the Q4 CEIR Total Index witnessed a 6.6 percentage point increase over Q3 2023.

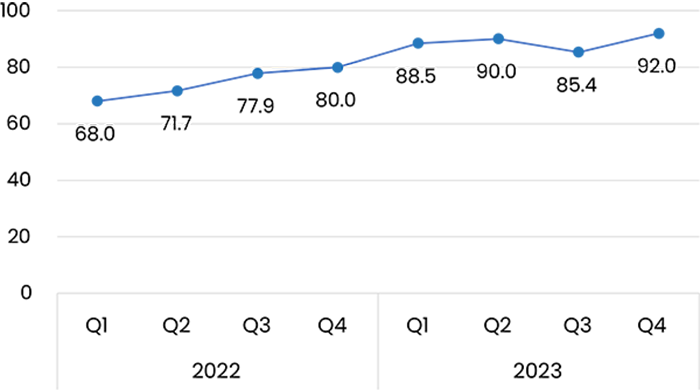

The period saw extremely low event cancellations and marked improvements across key performance metrics, propelling the Q4 2023 Index value to 92.0 (Figure 1) compared with 100.0 in 2019, according to the report.

Approaching Pre-Pandemic Levels

The good news: 31% of events in Q4 2023 exceeded their pre-pandemic performance levels (via the 2019 CEIR Total Index results), up from 23% in Q4 2022, according to an analysis (Figure 2) comparing industry performance from Q1 2021 through Q4 2023 to equivalent quarters in 2019 that highlights the recovery trajectory.

Figure 2 illustrates exhibition industry performance for events occurring between Q1 2021 and Q4 2023, compared to the same quarter in 2019, highlights the recovery trajectory, with the Q4 2023 results demonstrating a rebound after a weaker Q3 2023.

In-person event cancellation rates remained low at 1.4%, matching the Q4 2022 rate of 1.3% and showing strong improvement from the 14.8% rate in Q4 2021.

“The latest CEIR Index readings confirm the resilience of exhibitions,” said Adam Sacks, president of leading independent global advisory firm Tourism Economics, an Oxford Economics Company. “The industry has full recovery in view with the Index just 8% below pre-pandemic levels, showing the enduring importance of exhibitions to company performance.”

Q4 2023 CEIR Metric Insights

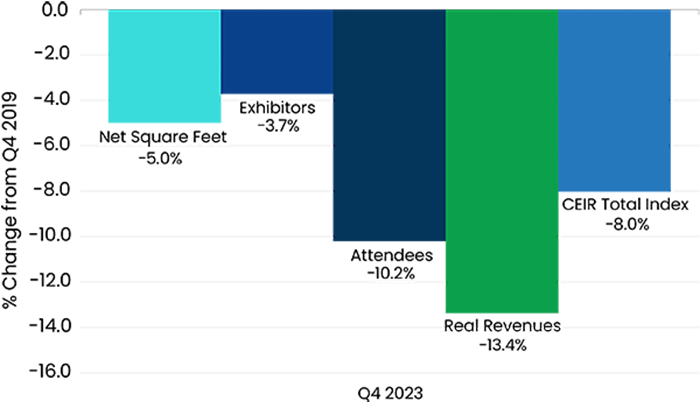

The recovery of the four main components of the Total Index varied, with the Exhibitors metric nearly reaching its Q4 2019 level, down by just 3.7%. Net Square Feet (NSF) saw a modest 5% decline, while Attendees and Real Revenues demonstrated a slower recovery, down 10.2% and 13.4%, respectively, from Q4 2019.

Although nominal revenue increased by 3.7% over 2019, higher costs eroded exhibition income value, with inflation adjustments revealing that real revenues are still 13.4% lower than in 2019.

U.S. Economic Forecast for 2024 Shows Promise

A strong labor market, moderation in inflation and the easing of financial market conditions have all contributed to a positive growth outlook, according to CEIR officials.

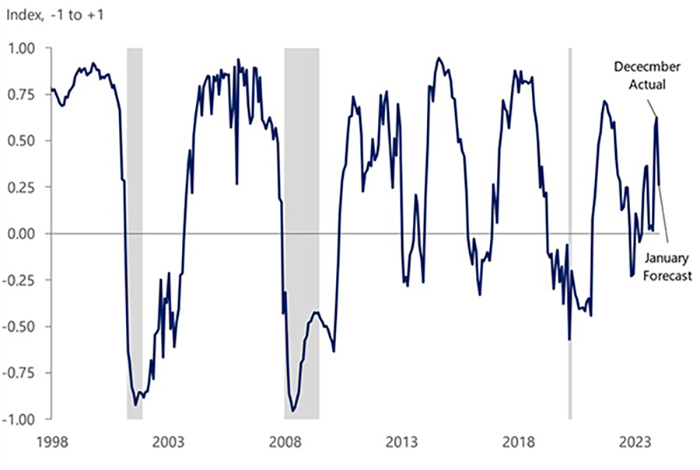

Oxford Economics’ business cycle indicator (BCI) is signaling economic resilience, with this index staging a robust recovery throughout Q4 and recording its highest reading in two years in December 2023 (Figure 4). Gains in the BCI were broad-based, with key contributors including continued strong gains in personal income and consumption levels, and a better-than-expected boost in industrial production in December, particularly from the mining sector and the normalization of automotive supply chains.

The outlook for the economy remains modestly optimistic, buoyed by a strong labor market, looser financial conditions and healthy household and nonfinancial corporate balance sheets. Oxford Economics places the odds of a recession at a low 30%, with key downside risks including supply-side and consumption weakness, fiscal policy uncertainties, geopolitical tensions and challenges in commercial real estate, primarily office space.

According to CEIR officials, Tourism Economics was tapped last fall to serve as CEIR’s consulting partner for its flagship exhibition industry performance-related research following the retirement of the organization’s 13-year resident economist, Dr. Allen Shaw, founder, president and chief economist of Global Economic Consulting Associates.

“I am pleased with the smooth transition of Tourism Economics producing the CEIR Index,” said CEIR CEO Cathy Breden. “The bench strength of the Tourism Economics team is evident, assuring the reliability of quarterly, historical benchmarks. The CEIR Index Report for 2023 will be published in late April, including a forecast outlook through 2026.